Robust forex trading system

Stepping back from the story of the cockroach and the cheetah , it seems that robustness is all about survival. Trading system robustness usually implies that the system exhibits similar performance when subject to slight variations. However thinking about it, you realise that this can mean several things: Also check that Trading Blox forum post for more discussion on robustness some of which directly inspired ideas in this post.

The second one is that creating a system using robust concepts and procedures, both in design and testing, should ensure that the system will show robustness. This generally starts with a trading strategy that makes sense, with few parameters, not many bells and whistles we do not want the Ferrari that looks good and go fast round the track but which can not go over speed bumps or underground car parks… Well, I do really…but you get the point!

Robustness of Algorithmic Trading Systems (That Work) - System Trader Success

Another aspect to consider when aiming to build a robust trading system is illustrated by this quote from Bill Eckhardt who aims to use robust tools and components in his systems:. We definitely use non-linear systems and non-linear indicators.

Linear indicators, such as filters with moving averages, have been mined dry. Possibly, using median instead of average in a trading strategy is more robust. The main aspect of robust system testing is to ensure that the back-test is realistic and that no over-fitting takes place.

Important points are good quality data, in-sample vs. This is when you change the parameters of the trading system. It is probably fairly easy to test and measure. Assume you have a Donchian Channel Breakout system with Channel length at 20 days and ATR-based stop at 30 days with a multiplier of 2. A robust system would exhibit very similar performance with slightly different parameters: Donchian Channel Breakout system with Channel length at 22 days and ATR-based stop at 33 days with a multiplier of 1.

There are quite a few things that can be changed such as the set of instruments traded small permutations should not affect performance drastically , testing period system performs similarly over all time periods , or even random slight amendments in actual prices. Unfortunately future price data is pretty hard to come by CSI are pretty good but they only provide historical data!

Feel free to email me if you have found a good provider ;- , so you obviously cannot test your system for future price robustness before putting it live. Arguably, the aim of focusing on robustness with the four previous points is to ensure that the system performs equally well on future prices.

However these four robustness aspects in a trading system can only act as a proxy for future prices robustness. It is up to us to decide and predict what parameters and proxies are important to ensure robustness in the future. This might sound like a paradox, but designing an automated trading system involves more discretion and prediction than one would think. Nice article on robustness, a term that has been used so much and so loosely that it has started to lose its meaning.

Also, that was an interesting quote about how one trader has abandoned moving averages and develops his indicators in-house. Your idea about median vs mean is an interesting one. Another variable that can be tweeked and should withstand some stress is the definition of price. We normally use the close as the definition of price.

Buy why not the high or the low, depending on how the market is trending? It is an interesting idea to break down robustness into components. I am not sure if I think about it in the same way.

Robustness is the ability of the system to perform well in changing conditions. Since the future conditions are never exactly the same as past conditions, a more robust system will make money in real trading than a less robust system. So, robustness is a measure of the likelihood that the system will perform similarly in real trading compared to development.

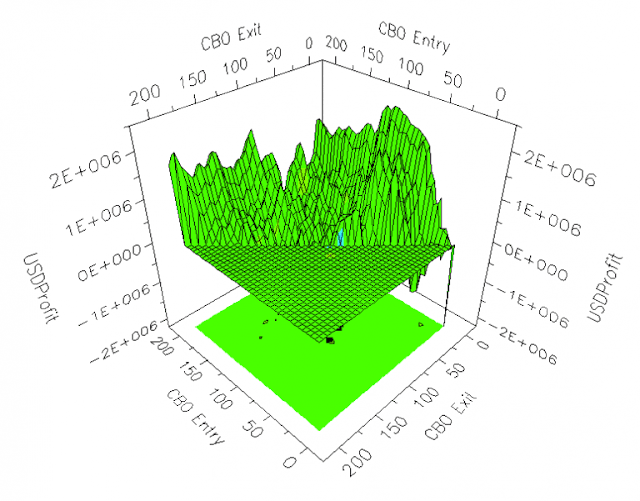

Your analysis does bring up an interesting question. If we can make our system robust to external changes, then how do we measure those changes? George, I think I was trying to expres a similar concept: In terms of measuring some robustness, I would think you can design an objective function to evaluate your trading systems and measure the standard deviation of this objective function when subjecting your system to changes.

I agree with your concluding statement that systems testing and design is far from an exact science. Turns out Robert Pardo is also a top trader. Yes, that makes sense.

Hi, I once researched a system for forex. It can make money in each of 7 major currency pairs from to with very small maximum drawdown. Even after changing the parameters somewhat, it is still very profitable.

I guess the reason is the introduction of Euro and the market price pattern changed somewhat after , so this system works well only at Do you think this kind of systems which can only perform well on recent year period is robust enough and should I confidently use it? Well — the problem with this kind of approach is that you are anticipating that the markets will be similar in the future to the period. Usually that would mean lower performance on period though… Now, even in system development there is some discretion involved and if you believe that conditions will stay as they are, you might want to stay with a system that works well only on the recent market conditions.

You could also potentially keep developing and monitoring your system to try and adapt it to changing conditions. I think your suggestion is very reasonable.

This system is a pull-back system. It follows the long-term trend, and wait the market has a pullback, then enter the market when the price exceed previous level. The result is if the price successfully surpass a significant resistance, it has a higher chance to continue higher.

But it seems this is not the case in In that period, many times the price just exceed an important resistance by a small amount and then quickly revert back.

I am not sure whether future price patterns will be like in , so I may prefer a system which can perform well in both time periods even with lower performance on Your suggestion to keep developing and monitoring the system to try and adapt to changing conditions is very helpful!

You can use these tags: Notify me of followup comments via e-mail. Sy blog, Systematic Trading research and development, with a flavour of Trend Following. Past performance is not necessarily indicative of future results. Futures trading is complex and presents the risk of substantial losses; as such, it may not be suitable for all investors. The content on this site is provided as general information only and should not be taken as investment advice.

All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author.

The author may or may not have a position in any financial instrument or strategy referenced above. Any action that you take as a result of information or analysis on this site is ultimately your sole responsibility. Sy blog — Automated trading System — Sitemap — Powered by Wordpress.

Robust Trading Systems Are the Goal of Trend Followers - TurtleTrader® The Original from Michael Covel

Sy blog — Au tomated Tra ding Sy stem. Wisdom Trading , a Futures Broker who can Execute your Trading System and provide access to Global Markets and CTA's — all at great rates.

Sy recommends CSI Data. Leave a Comment Cancel Name Mail Website XHTML: Free Updates By Email: Trend Following Wizards performance A trick to reduce Drawdowns Trading Blox review Better Trend Following via improved Roll Yield e-ratio: How to measure your trading edge in 4 easy steps A practical Guide to ETF Trading Systems Which CTAs REALLY provide alpha and HOW do you calculate it?

Were the Turtles just lucky? Check the list of global futures markets Wisdom Trading offer access to, from Maize in South Africa, Palm Oil in Malaysia to Korean Won, Brazilian Real or Japanese Kerosene to name a few, it is impressive and great to benefit from diversification.

Enter your email address: