Rolling option trades

December 8, by Brian Overby. Rolling Can Help You Dodge Assignment Rolling is a way of trying to put off assignment or avoid it altogether. Rolling can get you the extra time you need to prove out your opinions, but it can also compound your losses. Stock XYZ at You earn a premium for selling the call, but you also take on an obligation: Rising stock prices are probably why the call owner exercised their right to buy anyway.

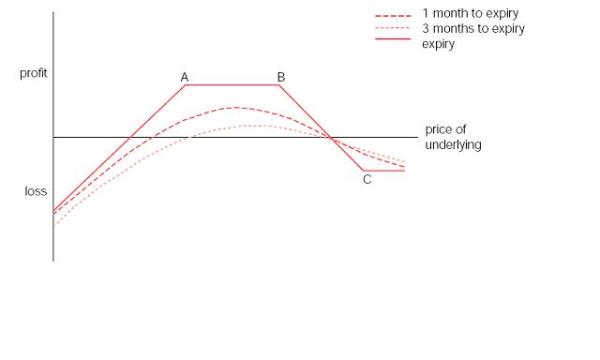

When the call is first sold, your potential profit is limited to the strike price minus the current stock price plus the premium received for selling the call. You receive a premium for selling the option, but most downside risk comes from owning the stock, which may potentially lose its value.

Since the stock is now in-the-money ITM , at expiration we will most likely be assigned. If only you could buy yourself a little more time, maybe you could prove your assumptions correct and eek out a little more profit on the stock.

Rolling is one way to respond to this situation. You can buy back and close the 90 call you sold, taking a loss on the call, but leaving you long stock with unlimited upside going forward. To do this we will enter an order to buy to close the short call and the sell to open a new call.

The new option will have a higher strike price and go further out in time. Moving up in strike will lower the premium received for a short call, but going out in a time will increase the premium. The net effect, we hope, will be a credit to the account for the entire trade. Check out the example in bold below. Buy to close the front-month 90 call Every time you roll, you may be taking a loss 2.

Rolling can be useful, but you should definitely go in with your eyes wide open. Brian Overby is Sr. Options Analyst at TradeKing , an online options and stock broker.

Brian appears frequently on CNBC, FOX Business, Bloomberg, and other financial media and is the author of the award-winning TradeKing Options Playbook.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options. While implied volatility represents the consensus of the marketplace as to the future level of stock price volatility or probability of reaching a specific price point there is no guarantee that this forecast will be correct. Any strategies discussed or securities mentioned, are strictly for illustrative and educational purposes only and are not to be construed as an endorsement, recommendation, or solicitation to buy or sell securities.

TradeKing provides self-directed investors with discount brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. Recent , Trading Lessons , Trading Lessons Tagged With: Brian Overby , options analysis , options buying , options contracts , options market analysis , options selling , Options trading , Roll Options Positions , Rolling , Rolling a Covered Call , trading strategy.

ConnorsRSI is the first Quantified Momentum Indicator -- the next-generation improvement to traditional RSI indicators.

At Connors Research, we are using it as an overlay to many of our best strategies to make them even better -- now you can, too. Enter your email address to get your FREE download of our Introduction to ConnorsRSI - 2nd Edition - Trading Strategy Guidebook with newly updated historical results.

The Connors Group, Inc. About Careers Contact Us Testimonials Link To Us. TradingMarkets PowerRatings Connors Research. ConnorsRSI Learn More About ConnorsRSI Recent Articles Store Books Free First Chapters Free Newsletters PowerRatings Buy the PowerRatings Algorithm Recent Articles.

Home Articles Connors Research ETFs Options Stocks Volatility Contributors Larry Connors Kevin Haggerty Matt Radtke Education Connors Research Glossary Moving Averages Options Options Trading VIX Interview Archive Trading Lessons Videos Guidebooks Courses Newsletters Store June 21, Have You Switched To ConnorsRSI?

Company Info The Connors Group, Inc. About Us About Careers Contact Us Testimonials Link To Us.

Vertical Roll - How to Roll an Option Position | InvestorPlace

Properties TradingMarkets PowerRatings Connors Research. The analysts and employees or affiliates of Company may hold positions in the stocks, currencies or industries discussed here. The Company, the authors, the publisher, and all affiliates of Company assume no responsibility or liability for your trading and investment results.

Factual statements on the Company's website, or in its publications, are made as of the date stated and are subject to change without notice. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable or that they will not result in losses. Past results of any individual trader or trading system published by Company are not indicative of future returns by that trader or system, and are not indicative of future returns which be realized by you.

Rolling Options Out, Up, and Down

In addition, the indicators, strategies, columns, articles and all other features of Company's products collectively, the "Information" are provided for informational and educational purposes only and should not be construed as investment advice. Examples presented on Company's website are for educational purposes only. Such set-ups are not solicitations of any order to buy or sell. Accordingly, you should not rely solely on the Information in making any investment.

Rather, you should use the Information only as a starting point for doing additional independent research in order to allow you to form your own opinion regarding investments. You should always check with your licensed financial advisor and tax advisor to determine the suitability of any investment.

SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. All analyst commentary provided on TradingMarkets.

The analysts and employees or affiliates of TradingMarkets. This information is NOT a recommendation or solicitation to buy or sell any securities. Your use of this and all information contained on TradingMarkets. Please click the link to view those terms.

Follow this link to read our Editorial Policy. Return to top of page.