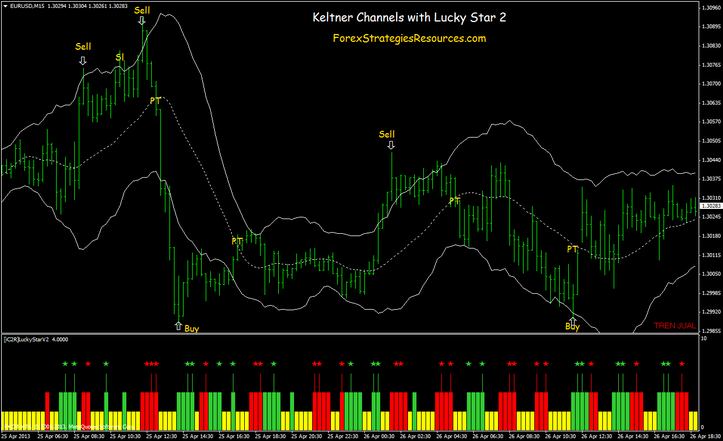

Keltner channel forex trading

Keltner Channels are volatility-based envelopes set above and below an exponential moving average EMA.

Keltner Channels Forex Trading System

This indicator is similar to Bollinger Bands; however the Keltner Channels use the Average True Range ATR to set channel distance instead of a standard deviation measure as with Bollinger Bands. Linda Bradford Raschke popularized a simplified version, using exponential smoothing and ATR, which is now more widely used. The channels are typically set two ATR values above and below the day EMA.

How to Day Trade with Keltner Channels

The EMA dictates direction and the ATR sets channel width. Keltner Channels are a trend following indicator used to identify reversals with channel breakouts and channel direction.

Traders should remember the following two points while defining your Keltner Channel trading strategy: The longer the length of the exponential moving average, the greater the lag on the indicator; and the higher the multiplier, the greater the width of the Keltner Channel. Trading signals can be created two ways using the Keltner Channel: During a clear trend, breakthrough above or below the envelopes can be a sign of underlying strength of the trend.

During a Bullish Trend, a breakthrough above the upper envelope can be seen as a sign of strength and the uptrend is likely to continue. During a bearish trend, a breakthrough below the lower envelope can be seen as a sign of weakness or bear trend strength and the downtrend is likely to continue.

Keltner said that a close above the upper band or below the lower band is evidence of a strong move and should be traded as a breakout. The following rules can be used by traders to trade Keltner signals in a trending market. Traders can carry on the long until they do not see a reversal pattern or do not close below the moving average, which happened on Aug. Traders can carry on the short until they do not see a reversal pattern, which happened on June 27, where it formed a doji pattern, suggesting a reversal.

Traders can book out on a reversal confirmation, which happened the next day. When a market is choppy or trading sideways, Keltner Channels can be useful for identifying overbought and oversold conditions. These conditions can typically lead to price corrections where price moves back toward the moving average. Go long when prices turn up at or below the lower band. Close your position if price turns down near the upper band or crosses to below the moving average. Go short when price turns down at or above the upper band.

Close your position if price turns up near the lower band or crosses to above the moving average. This allows traders the ability to earn consistent small short-term profits, as with our example in Alcoa AA.

Keltner Channels are a trend-following indicator designed to identify the underlying trend. When it comes to successful trading, trend identification is half the battle. The trend can be up, down or flat.

Using the methods described above, traders and investors can identify the trend to establish a trading preference. Bullish trades are favored in an uptrend and bearish trades are favored in a downtrend.

A flat trend requires a more nimble approach because prices often peak at the upper channel line and trough at the lower channel line. As with all technical indicators, Keltner Channels should be used in conjunction with other indicators and analysis.

Momentum indicators offer a good complement to the trend-following Keltner Channels. Bramesh Bhandari is a proficient trader on the Indian stock market. He analyzes forex, commodity and world indexes, and also provides online tutoring on technical analysis to traders. Bramesh Bhandari is a proficient stock trader at Indian stock market. He share his insight in Forex,Commodity and World Indices through his site http: He also provides online tutoring on technical analysis to traders.

He can be reached at bhandaribrahmesh gmail. Free Newsletter Modern Trader Follow. We asked traders what FBI Director Comey's testimony means for stocks and other markets.

Silver holding huge commercial short.

Forex Flex EA - The Best MT4 Forex EA

Retail is in trouble because of economic conditions. What does this mean for the markets?

free-trading-videos-1

Election play in gold options. Trading Keltner Channels While the grand number of available technical indicators can threaten paralysis by analysis if you tried to use them all, Keltner Channels offer a unique view of trends and are worth a look.

Calculation There are three steps to calculating Keltner Channels: Select the length for the exponential moving average. Choose the time periods for the ATR. Choose the multiplier for the Average True Range. By default technical analysts use period EMAs with envelopes using ATR and a multiplier of 1: Trend confirmation During a clear trend, breakthrough above or below the envelopes can be a sign of underlying strength of the trend.

Longs initiated when price breaks above the upper band with a stop loss below the moving average middle line and exit if price closes below the moving average middle line. Shorts initiated when price turns below the lower band with a stop loss above the moving average and exit if price crosses above the moving average middle line.

About the Author Bramesh Bhandari is a proficient stock trader at Indian stock market. Mid-Week metals market report from Friday.

The lead-cinch option trade. How to trade your dragon.

Related Articles Morning Mash Daily Price Action: Previous The lead-cinch option trade. Next How to trade your dragon.