Stock market crash qe3

Despite all of its pops higher and lower, the stock market only looks volatile over the past 14 months or so. Equities are almost right where they were when the market closed on Oct. It is, of course, the very day the Federal Reserve announced it had concluded the third round of its massive money-printing operation known as quantitative easing.

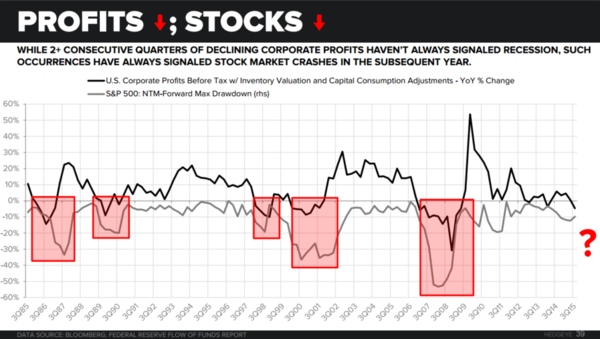

The Fed had been using its digital printing press to gobble up bonds, an operation that in turn was helping drive liquidity and boost asset prices in hopes of goosing economic activity,. Read More More market trouble is just around the corner. The result was an anemic economic recovery but a stunning rise in stocks — percent in all off the March financial crisis lows.

Since that hallowed date? The market was trading Tuesday within a couple points of where it was the day the Federal Open Market Committee announced it was cutting off the market's lifeline. These levels have been breached before, most notably in August , but the recent trend of lower highs is saying something about risk appetite," Citigroup analysts said in a note Tuesday.

Robert McHugh | bozirixejiwi.web.fc2.com

Sure, there have been peaks and valleys since the Fed took away the QE portion of the punch bowl. But stocks have been trapped in a pretty vicious range post-QE3, plunging amid geopolitical turmoil, fears of a hard landing in China and tumbling energy prices, then turning higher again after the storms temporarily passed. Indeed, the market has backstopped the losses.

QE3 R.I.P., What It Could Mean for Stocks — Money and Markets - Financial Advice | Financial Investment Newsletter

Read More The Fed in THIS is what to watch out for. Since the end of QE, the Fed has sought to begin the other step towards policy normalization.

At the December meeting of the Federal Open Market Committee, the central bank approved the first hike to its key funds rate in more than nine years. Expectations differ on what happens next: Fed officials, through their individual projections, expect the FOMC to hike four times this year. Market participants, though, doubt that will happen, with expectations now for two or three hikes. They may not be able to.

Stocks, more than housing, seen as initial QE3 winners | Reuters

Fed officials appear cognizant of the effect loose policy has had on financial markets. Recent statements from senior members that had a hawkish bent have helped contribute to the instability that has marked early trading. The question, then, will be whether the Fed can maintain that resolve should the market continue to show the inability to grow without the Fed's largesse.

Asia Europe Stocks Commodities Currencies Bonds Funds ETFs Investing Trading Nation Trader Talk Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Screener Fund Screener Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Make It Entrepreneurs Leadership Careers Money Specials Shows Video Top Video Latest Video U.

Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes Shows Watch Live CNBC U. Business Day CNBC U. Primetime CNBC Asia-Pacific CNBC Europe CNBC World Full Episodes.

Log In Register Log Out News Economy Finance Health Care Real Estate Wealth Autos Consumer Earnings Energy Life Media Politics Retail Commentary Special Reports Asia Europe CFO Council. Asia Europe Stocks Commodities Currencies Bonds Funds ETFs.

Make It Entrepreneurs Leadership Careers Money Specials Shows Investing Trading Nation Trader Talk Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Screener Fund Screener.

Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Video Top Video Latest Video U. Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes.

Primetime CNBC Asia-Pacific CNBC Europe CNBC World Special Reports Top States Paris Airshow Trailblazers Trading the World CNBC Disruptor 50 Lasting Legacy Modern Medicine College Game Plan Investing in: Israel Tech Drivers The Brave Ones Trading Nation Shaping the future Future Opportunities.

Register Log In Profile Email Preferences PRO Sign Out. Not for this stock market Jeff Cox JeffCoxCNBCcom. What's next for the Fed? That date may ring a bell. The floor of the New York Stock Exchange at the closing bell on Oct. The Federal Reserve phased out its bond purchasing program while keeping interest rates near zero for a "considerable time.

But there has been little to spur any lasting gains. THIS is what to watch out for Since the end of QE, the Fed has sought to begin the other step towards policy normalization. Jeff Cox Finance Editor.

To view this site, you need to have JavaScript enabled in your browser, and either the Flash Plugin or an HTML5-Video enabled browser. Download the latest Flash player and try again. YOUR BROWSER IS NOT SUPPORTED. Please upgrade to watch video. The requested video is unable to play.

The video does not exist in the system. Please disable your ad blocker on CNBC and reload the page to start the video.