Cibc money market fund performance

To obtain a high level of income consistent with preservation of capital and liquidity by investing primarily in high quality, short-term debt securities issued or guaranteed by the Government of Canada or any Canadian provincial government obligations of Canadian banks, trust companies and corporations.

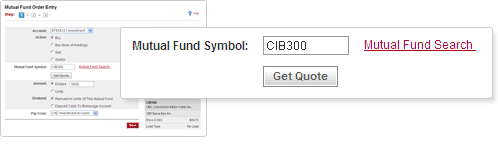

Management Report of Fund Performance. Calculated and accumulated daily and distributed monthly. Pre-Authorized Chequing Investment PAC or Group RRSP: Withdrawals may be made monthly, quarterly, semi-annually or annually.

Annualized Management Expense Ratio including applicable taxes as at August 31, CIBC Asset Management is one of Canada's largest asset management firms and provides a broad range of high-quality global investment management solutions to retail and institutional clients. Lessard is a member of the Global Fixed Income team operating from within the firm's Investment Management Platform.

Renaissance Money Market Fund - Renaissance Investments

Steven Dubrovsky, CIBC Asset Management Steven Dubrovsky joined CIBC Asset Management Inc. Dubrovsky is a member of the Global Fixed Income team, operating from within the firm's Investment Management Platform.

Current Yield Current yield is an annualized historical yield based on the seven-day period ended on that day and does not represent an actual one-year return. For bonds or notes, the coupon rate divided by the market price of the bond. The rate of return or mathematical table shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the fund or returns on investment in the fund.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Renaissance Investments family of funds simplified prospectus before investing. The indicated rates of return are the historical annual compounded total returns for the class A units including changes in unit value and reinvestment of all distributions, but do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns.

Mutual fund securities are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer, nor are they guaranteed.

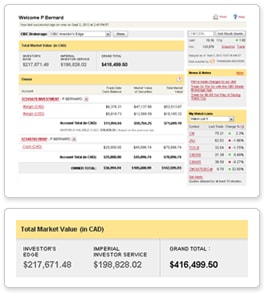

CIBC Money Market Fund – Class A Units | CIBC

There can be no assurance that a money market fund will be able to maintain its net asset value per unit at a constant amount or that the full amount of your investment will be returned to you. The values of many mutual funds change frequently.

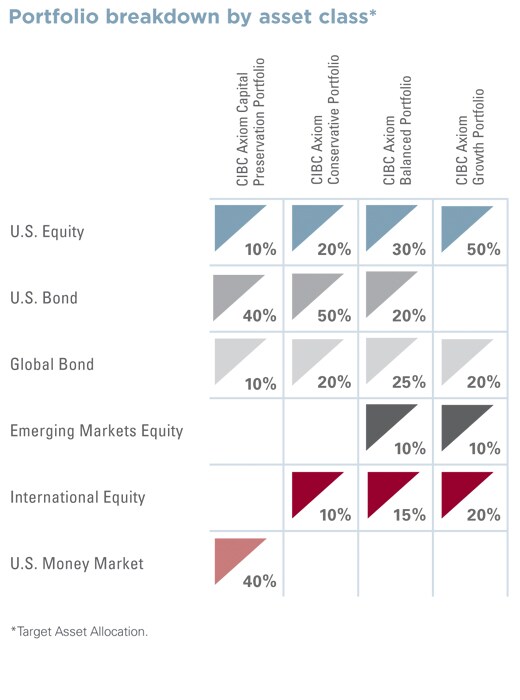

Past performance may not be repeated. Copyright CIBC Asset Management Inc. Renaissance Investments and Axiom Portfolios are offered by CIBC Asset Management Inc.

Additional Fund Information Management Report of Fund Performance Fund Profile Fund Facts. Annual Management Fee excluding applicable taxes: CIBC Asset Management CIBC Asset Management is one of Canada's largest asset management firms and provides a broad range of high-quality global investment management solutions to retail and institutional clients.

Performance 3 mo 6 mo 1 yr 3 yrs 5 yrs 10 yrs YTD Since Inception 0.