Puttable bond option

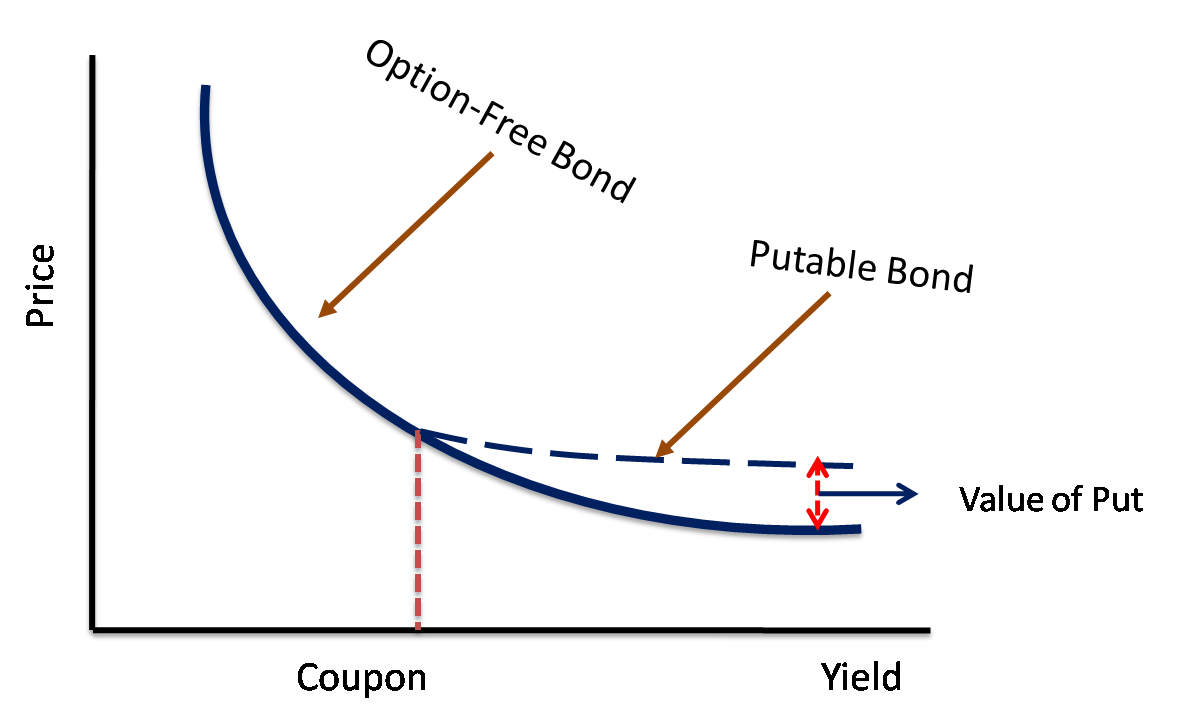

When we are ignoring volatility and simply looking at the change in interest rates, I wanted to know what the NET effect of the putable change is. If we expect the yield curve to upward slope then rates are rising and bond prices are falling. Therefore, the Put becomes more valuable increases in the formula above.

However, the straight bond moves inversely and therefore decreases as rates rise. What is the net effect, the putable increases or decreases? As rates rise, yes, the value of the straight-bond falls and the value of the put option embedded rises.

Free 7 Day Trial

Meaning, if interest rates fall the value of the bond will increase by more than what effective duration predicts, and conversely, when interest rates rise the value of the bond will decrease by less than what effective duration predicts. In that space is our power to choose our response. In our response lies our growth and our freedom.

Puttable financial definition of Puttable

Ignore my comment above. AnalystForum is an online community designed exclusively for CFA candidates and charterholders to discuss the Chartered Financial Analyst program. Skip to main content. Be prepared with Kaplan Schweser. CFA More in CFA CFA Test Prep CFA Events CFA Links About the CFA Program.

CFA Forums CFA General Discussion CFA Level I Forum CFA Level II Forum CFA Level III Forum CFA Hook Up.

Put Bond

More in CAIA CAIA Test Prep CAIA Events CAIA Links About the CAIA Program. More in FRM FRM Test Prep FRM Events FRM Links About the FRM Program. Test Prep Sections CFA Test Prep CAIA Test Prep FRM Test Prep.

Fixed Rate Call/Put Bond OverviewHome Forums CFA Forums CFA Level II Forum Interest Rate changes on Putable bond Tweet Widget Facebook Like Google Plus One Linkedin Share Button. CFA Level II Candidate AF Points.

Cross the Finish Line with a Comprehensive Final Review. Tactics Apr 26th, 9: Interested to know too. Black8Mamba23 Apr 26th, Thanks Blackmamba, I am still a little unsure what your final answer is though. So in a MCQ format Q: Rates rise, what happens to the puttable bond?

TomRiddle Apr 27th, 9: CFA Level II Candidate 84 AF Points. The putable bond increases in value. Black8Mamba23 Apr 27th, TomRiddle Apr 27th, This Post Is Filed Under: Fitch Learning - Toronto - Top 10 Common Pitfalls to Avoid - FREE EVENT. About AnalystForum AnalystForum is an online community designed exclusively for CFA candidates and charterholders to discuss the Chartered Financial Analyst program.