Backtesting options strategies

This free educational website is intended to allow you to compare popular technical trading strategies as scientifically as possible through backtesting. In general, it is pretty hard to consistently beat the market and you should be skeptical of anything that tells you otherwise.

This site allows you to backtest some common technical strategies to see how they would have performed against the market and lets you screen for the stocks that meet your trading criteria. Strategies that backtest well, of course, do not guarantee success going forward but could have a higher probability of performing well.

Backtesting also enables you to see the market conditions in which a certain strategy will perform well. For example, if you are confident the market will be range bound going forward, you can find out what strategies perform best in this type of market. This is done by backtesting over historical timeframes that were range bound and seeing which strategies are best. Backtesting also helps you see which strategy parameters are most robust across different time periods.

Thus, backtesting can provide valuable trading insights even though it cannot guarantee the future. Some interesting things you might discover: Select the stock you want to backtest your technical strategy on. Amount of money you start with Stoploss: Point at which you want to get out of a position moving against you.

A regular stop means you will get out of your position if the stock falls a set percentage below where you bought it. Sell when your stock attains a certain percentage gain Can turn off by selecting Don't Use Target. Select the historical dates between which you want to test the strategy.

Signals involve the crossings or relations between price and technical indicators. For example, the golden cross, buy when the 50 day simple moving average sma crosses above the day sma and sell when the 50 day crosses below the day death cross.

The following links backtesting options strategies some popular technical indicators: Simple Moving Average Exponential Moving Average Bollinger Bands. Get trades will literally show you the trades you would have made if you went back in time with a summary of performance included.

backtesting - Are there any good tools for back testing options strategies? - Quantitative Finance Stack Exchange

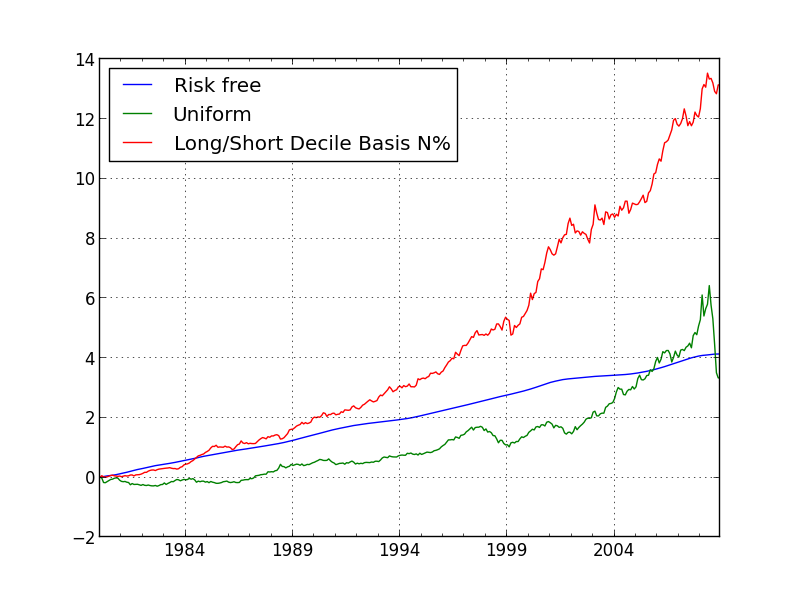

We want to know how confident we can be to reject that the two returns are the same. The graph plots the value of the portfolio over time with an included summary of the performance.

This is for backtesting a strategy that you would apply to your portfolio as stocks reach your technical buy and sell signals. In the first textbox, enter the tickers for the basket of stocks you want to backtest your technical strategy on. Enter each ticker separated by a space. Stocks currently available include the 30 dow stocks, AA AXP BA BAC CAT CSCO CVX DD DIS GE HD HPQ IBM INTC JNJ JPM KFT KO MCD MMM MRK MSFT PFE PG T Alternative trading systems sec UTX VZ WMT XOM.

To include all 30 in the backtest, just type DJIA which is the default. Target Number of Open Positions: This is the number of stocks you want to have a position in and waktu terbaik untuk trading forex more.

For example, lets say you want to target 2 open positions. When the backtester finds a buy signal in one of the stocks you put in the basket, say GE, it will assume GE was bought.

Livevol

It will now look for 1 more stock to buy when there is a buy signal, say BAC. You now have a portfolio of 2 open positions GE and BAC and the backtester will not buy any more until a sell signal sells one of the stocks. A diversified portfolio should probably have 10 or more stocks, but this takes a lot of computing power to backtest.

Stocks & Options BackTesting Strategies Platform

Thus, a small portfolio like the default of 5 open positions will suffice to get a sense of a strategy's performance. ETFs are a cheap way to get diversified. Amount you pay TDAmeritrade, SOGO, ScottTrade, etc to trade a stock.

This is how you decide to commit a certain amount of money to each stock in your portfolio. Currently only one option Equal Cash Allocation is available. In other words, cash available will be equally divided towards new positions until I reach my target n number of open positions.

Other options to come will be equal number of shares, and volatility based position sizing rules. The backtester will start at the start date in historical data and will search through the stocks you selected until it fines a buy signal.

If no buy signals are found on the first day, the backtester moves to the next day and searches through all the stocks in the basket until a buy signal is found in which the stock is assumed to be bought at the close price adjusted for splits and dividends.

As soon as a stock is "bought", the backtester will be looking to sell that stock when a sell signal comes. It also continues to look to buy stocks until the target number of open positions is reached. At the same time, it will sell any existing positions if a sell signal occurs.

The value of the portfolio is calculated everyday until the end date. The content on this site is for informational purposes and is not to be taken as investment advice.

Amount of money you start with Trading Commission: Amount you pay TDAmeritrade, SOGO, ScottTrade, etc to trade a stock Position Sizing: